Check Bounced Called Bank to Rrquest Runnimg Check Again

Ofttimes asked questions near mobile cyberbanking

Nosotros're focused on delivering the best service possible. From downloading the Huntington Mobile app to depositing money, nosotros can help you bank meliorate.

FAQs

Alerts

When I update my email and telephone number through alerts, does it update other Huntington accounts?

Answer: No, updating your contact information for your alertsone volition not update your business relationship info everywhere else. For example, if yous have a mortgage, your mortgage contact data will stay the same.

Can I set up alerts for my business accounts?

Answer: Yes, many business concern checking and savings accounts are eligible for alerts by email, text message, and push notificationsane. To sign upwardly for business organization alerts, log into your Business Online business relationship and click Alerts at the peak. Enroll in Alerts then go to Manage Alerts for the full listing of alerts and preferences to receive them.

Does information technology matter if I use uppercase or lowercase letters for activation codes?

Reply: Activation codes are not case sensitive.

Is there a fee for using alerts?

Answer: Huntington doesn't accuse to send you alerts1 simply your carrier may charge you data fees. Please contact your mobile carrier for details.

Can I ready do not disturb times for alerts?

Answer: Yes, you tin set time preferences (Practice Not Disturb) for when you don't want alerts delivered by email, text, or push notification. The alarm(south) will be sent once the Practice Not Disturb time you set is over1. Delight note, you will still receive certain disquisitional or fourth dimension-sensitive alerts during your Do No Disturb fourth dimension, including 24-60 minutes Grace® † alerts.

Mobile App General

How do I download the Huntington Mobile app?

Answer: In one case you are enrolled in Huntington online banking, you tin download and begin using the Huntington Mobile app. Download the app from the App Store (Apple tree) or get it on Google Play (Android). Just search for "Huntington Mobile."

The app didn't download. What'south going on?

Respond: Be sure to check your network connection. If that seems to exist working, then check to encounter if the device is blocked from downloading apps. For example, if you take an iPad issued by your employer, at that place may exist firewalls in place that block you from downloading the app.

Which accounts are eligible to be accessed on the Huntington Mobile app?

Answer: With the exception of sure investment accounts, accounts eligible for online banking volition exist viewable within the app.

What Operating Systems (Bone) are supported?

Answer: The Huntington Mobile app supports iPhones and iPads running iOS 10.3 or college and Android smartphones and tablets running version 5.0 or higher.

I already have the app, how practice I update it?

Answer: Apple users tin can go to the App Store to view the available updates. Android users can get to Google Play to view the bachelor updates. If your device is setup for automatic updates, the Huntington Mobile app will be updated automatically.

When I update the app, volition I have to re-annals my device or setup Affect ID or Quick Balance again?

Answer: Nigh of the time you will non be required to re-register. Notwithstanding, some security updates made to the Huntington Mobile app to protect client information will require re-registration.

Mobile App Login and Security

What is Mobile Secure Login and why does the app now include it?

Respond: For the security of your accounts, your Huntington Username and Password are required in order to access the app. As an added level of security, Huntington likewise requires you to register your mobile device with usa. We phone call it Mobile Secure Login. Registering your device enables us to necktie your specific mobile device to your login credentials, which allows us to place you with both something you lot know (your username and password) and something y'all take (your mobile device).

What if I do not see my desired contact method in the list?

Answer: Log into huntington.com and update your phone number or email under the My Profile section. (To run into the newly provided information in the Huntington Mobile app, you lot'll need to log out and so log back in).

What if I asking a registration lawmaking and do not receive it?

Answer: Codes are sent immediately when requested. If you lot did not receive the code within a few minutes, please ensure your contact data is correct and that yous are selecting the correct method. You may and so asking a new registration code.

What if I asking a registration code be texted and do not receive it?

Reply:

Outset, please ensure that the phone number you selected can receive text messages. Second, check the listing of our participating carriers to meet if your mobile carrier is supported. Lastly, information technology may be because y'all or your carrier has blocked messages from short codes. Huntington sends these registration text messages from our short code 446622. Delight call your mobile carrier and enquire nigh short code messaging.

Tin the registration lawmaking that I receive exist used multiple times?

Answer: No, the registration code that is sent to you lot can but be used to register 1 mobile device. Information technology will expire once yous successfully enter information technology on the registration page (or after 30 minutes if left unused).

How long are registration codes valid?

Answer: Registration codes expire xxx minutes from the time of your request. If y'all enter the registration code on the registration page and receive an error message, please verify that you are entering the half-dozen-digit number correctly and properly entering your password before trying again. For your security, accounts volition be suspended if likewise many unsuccessful attempts are fabricated.

How many attempts practice I have to enter my registration code correctly?

Answer: Y'all have five attempts to enter the registration lawmaking correctly.

What is my Security Question?

Answer: If you lot received your registration lawmaking via e-mail, you'll be required to answer a security question. This question is one that you set upward when you originally registered for online cyberbanking. Too, you tin manage your list of Security Questions past logging into huntington.com and navigating to the Service Center (under the Customer Service tab). The click Update My Security Questions.

Why would I select to NOT remember my device?

Answer: Strictly for personal security. You may be using a device that isn't yours, or is shared or public, or is one you don't employ ofttimes. Please note that when y'all select to non remember a device, you volition be prompted to get through the registration process each time you log in.

I changed my username. Why are my devices no longer recognized?

Answer: Whenever you change your username, we ask you to re-register your devices. This is to protect the security of your business relationship(due south).

Can I view a listing of the devices that I have registered?

Reply: Yes, you lot can view a list of registered devices within the Settings department of the Huntington Mobile app. Merely select the Carte button, then My Settings. To view the list, select Manage Registered Devices. Y'all will also detect the date each device was final used to access your account(due south).

What should I do if I practise not recognize one of the registered devices?

Answer: You can delete unrecognized devices by opening the Huntington Mobile app, logging in, and so selecting the Carte icon at the bottom of the screen. From there, just tap My Settings and and then Manage Registered Devices. To delete a device, tap the Edit button and select the device(due south) you lot wish to delete by tapping the small crimson circumvolve(southward) adjacent to them. Then, tap Delete to unregister the device(s) from your account.

Why is my device showing up multiple times in my registered devices list?

Answer: If y'all've previously registered your device and and so deleted and reinstalled the Huntington Mobile app, you may meet your device displayed more than than once in the listing. If you wish, you may remove the device entry used longest ago. Unused devices will be removed after 90 days.

Why is my device displaying every bit unrecognized when I know I previously chose to recall it?

Respond: Occasionally, changes to your device such as operating system upgrades will require yous to re-annals with Huntington. Also, if you oasis't used your device to access your accounts in 90 days, you may be required to annals it again. We inquire this of our customers equally a security measure out.

Why exercise I get an error when I enter a registration code that I requested from some other device?

Answer: This is an added security measure from Huntington. Registration codes are unique to the device from which they are requested.

Mobile Eolith

What is Mobile Deposit?

Reply: Huntington's Mobile Eolith feature lets you eolith checks from your mobile device, which saves you time by reducing trips to a branch or ATM. (Please note that Huntington supports iPhones and iPads running iOS ten.three or higher as well as Android smartphones running version five.0 or higher. A minimum 2 megapixel rear facing camera is as well required.)

Will I be charged a fee to use Mobile Deposit?

Answer: There'southward no fee to employ Mobile Deposit. That said, your carrier'southward standard data rates may employ.

What types of accounts are eligible for Mobile Deposit?

Answer: Most Huntington checking, savings, and coin market accounts that are enrolled in online cyberbanking are eligible to employ with Huntington Mobile Deposit.

What type of checks can I eolith with Mobile Deposit?

Answer: Eligible checks more often than not include checks that are in their original form, made payable directly to you lot, in U.Due south. Dollars, and drawn confronting a U.Southward. Fiscal institution.

Are in that location whatever types of checks that cannot be deposited through Mobile Deposit?

Respond: A few examples of non-eligible checks are: money orders, savings bonds, and travelers' checks.

How should I endorse my check when using Mobile Eolith?

Respond: All checks must be signed by the depositor(south). For extra security, you should also include "For Deposit Merely – Huntington Bank" beneath the signature too.

Are the check photograph taken of my deposit stored anywhere on my device?

Answer: No, bank check images are permanently deleted from your device after being sent directly to Huntington.

Are at that place whatsoever restrictions to the amount of money I can eolith through the Huntington Mobile app?

Respond: Yes, limits may be established on the number of checks and the total dollar amount of checks deposited through Huntington Mobile Eolith. Limits may vary past customer and may change over time. Customers can view their limits from within the app. Tap the Deposits button and follow the instructions.

What should I do with my check after I have submitted a eolith through Huntington Mobile Deposit?

Respond: In one case you've submitted your eolith, we recommend writing the date of the deposit on the front end of your check forth with "Huntington Mobile Deposit." Later the funds accept been properly credited to your account, look 14 days and so destroy the cheque.

When will I encounter my eolith posted to my account when using the Huntington Mobile app?

Answer: If you lot make a deposit on a business concern day before midnight, we will consider that day to be the day of your deposit. However, if you make a deposit on a not-business twenty-four hour period (Saturday, Sunday or Federal holiday), nosotros volition consider that eolith as being made on the side by side business day we are open.

When will I have access to my funds through the Huntington Mobile app?

Respond: Funds are generally available inside 2 business organisation days later your deposit. Still, some exceptions may utilize. Meet our Mobile Deposit Terms for more information.

Can I see images of the checks I deposit?

Respond: Yes, from inside the Huntington Mobile app, go to Deposits and and so History. A list of all of your mobile deposits from the last threescore days is displayed and images of those checks are available to view equally well.

Why was my mobile check deposit corporeality changed OR why was my deposit not accepted?

Answer: All deposits are subject to our verification procedures and we may refuse, limit or render deposits for any reason. If there is a modify to your deposit amount or condition, Huntington will contact you to let you lot know.

I'm having trouble getting my cheque images to be accepted. What can I do?

Reply: Make certain that you have placed the bank check on a dark or contrasting background confronting so it volition stand out. Ensure that all four corners of the check are visible in the pic. Employ a steady hand to reduce paradigm mistiness and take the picture in a properly lit area. If that notwithstanding doesn't piece of work, stop by your local Huntington branch and we'll help yous figure it out.

Can I use Mobile Eolith to to make my first eolith into a new business relationship?

Answer: Mobile Eolith is non currently available to fund a brand new account. Delight visit your local branch to brand your showtime deposit.

Mobile Payments

Tin I create, edit, and delete Beak Pay payees in the app?

Answer: Yes. To add a new Neb Pay payee, simply tap the plus symbol (+) next to Select a Payee. Too, within the Payments section of the app, you tin can manage your Bill Pay payees by tapping Payees.

Can I enroll in Bill Pay in the app?

Reply: No. For the fourth dimension existence, you must enroll in Bill Pay through huntington.com.

What accounts can exist used to pay bills?

Answer: Any eligible checking account can be used for neb payments. In the Huntington Mobile app, your eligible accounts are automatically listed on the Payment Summary screen when you lot tap From.

When I'm making a bill payment in the app, when are funds removed from my business relationship?

Respond: Huntington deducts the money from your account on the payment date you specify. Here are the different scenarios that could occur.

- Weekday, before 8:00 p.m. ET: If y'all brand a pecker payment and schedule information technology for the current day, and it's a weekday, before 8:00 p.thou. ET, Huntington deducts the money from the funding account right away.

- Weekday, after 8:00 p.m. ET: If you make a bill payment and schedule it for the current day, and it's a weekday, after 8:00 p.grand. ET, Huntington deducts the money from the funding account on the morn of the next concern twenty-four hour period. Business days are Monday through Friday and do not include banking company holidays. (So if yous make a pecker payment on Friday after 8:00 p.one thousand. ET, continue in mind that it won't be processed until Monday morning.)

- Weekend or Holiday: If yous make a nib payment and schedule information technology for the electric current 24-hour interval, and it'southward the weekend or a bank vacation, Huntington deducts the money from the funding account on the morning of the next business day.

- Future Payments: If you schedule a bill payment for a particular day in the future, Huntington will deduct the coin from the funding account on the morning time of the day on which it is scheduled. If your scheduled engagement falls on a weekend or bank holiday, and so the funds will exist deducted on the morn of the next business 24-hour interval.

When should I schedule payments?

Reply: Electronic payments should be scheduled at least 2 business days before payment is due. Payments mailed via U.S. Postal service should exist scheduled at to the lowest degree v concern days before payment is due. You tin can tell whether a payee receives electronic or mailed payments by noting the icon related to the payee on the "Pay Bills" screen. If the icon is a lightning bolt, the payment will be sent electronically; if the icon is an envelope, a check volition be mailed to the payee.

Other Mobile Features

Why exercise simply sure branches or ATMs show upward in search results on mobile?

Answer: Based on the entered search criteria or your current location, the 25 closest branches and ATMs will be returned (provided that Huntington has that many locations within 50 miles).

What is Mobile Quick Balance?

Answer: Quick Balance provides mobile customers with a more convenient way to view business relationship balance information. With only a single tap on the login page, you tin can easily admission your checking, savings, money market place and/or Voice Credit Carte® account balances. This is an optional characteristic and customers must opt-in prior to using the characteristic. Simply follow the instructions on the login screen of the app.

What accounts are eligible for Quick Balance?

Answer: Currently, Quick Balance is only available for checking, savings, coin marketplace, and Vocalisation Credit Card® accounts.

How secure is the Quick Balance feature?

Respond: Quick Residuum uses your username and your registered device to authenticate your account prior to displaying account balances. Therefore, to utilise the Quick Residue feature, you lot must commencement have your phone registered through the device registration process and your username populated (either by typing it in or having it previously saved). Account nickname, masked business relationship number, and electric current balance are the simply information that is displayed for accounts y'all have enabled for this characteristic. This data is similar to that displayed for account alerts, text banking, ATM receipts, and banking company statements. You lot take the choice as to whether to turn ON this characteristic both as a global app setting and at an individual account-level setting.

How are the accounts named that are displayed on the mobile app?

Respond: The first 20 characters of the account nickname that you have provided within online banking along with the last four digits of the account number (the number that Huntington assigned to identify this account) will be displayed on both the login page and the settings page. In the absenteeism of a nickname, this defaults to the first 20 characters of the business relationship type. This name is the same name that is used on the Accounts screen within the app.

How will the balances be displayed on the app?

Reply: Your current account balance(s) will be displayed formatted every bit currency, e.thousand. $500.00.

Which account balance(s) will be displayed on the login screen of the app?

Answer: We only display the balances for accounts that you lot have turned on using Quick Balance. To arrange the accounts displayed, simply log into the app. Then tap on Bill of fare in the bottom navigation bar. In My Settings, you have the ability to turn eligible accounts On or Off.

What does the residual displayed include?

Respond: Your account balance reflects the sum of today'southward beginning residual plus whatsoever pending transactions.

What is "today's beginning balance?"

Answer: Today'south offset balance is the amount in your business relationship after the previous business day's processing. This balance does not consider today'due south transactions, transactions that mail on weekends or holidays, or overdraft lines of credit. Transactions clear Mondays through Fridays except holidays. Example: A transaction that arrived Saturday would exist processed Monday and would announced in Tuesday's beginning balance.

What are "pending transactions?"

Answer: Awaiting transactions are electronic transactions that volition be processed today. There may be other transactions (checks, mobile deposits, etc.) that are not included, but even so volition be candy today as well.

Does the balance displayed within Quick Residue include overdraft protection?

Reply: No, the account balance(southward) displayed within Quick Balance does not include Overdraft Protection (line of credit).

How will my balance display inside Quick Balance if I accept overdrawn my account?

Respond: If your business relationship is overdrawn, the account rest will display within Quick Residuum with a negative sign, e.grand. - $20.00.

I lost my telephone and I have Quick Remainder enabled. What should I do?

Reply: Yous have two courses of action and both are equally secure. You can either alter your username at huntington.com, or call u.s.a. at (800) 480-2265, daily 7:00 a.thousand. to 7:00 p.k. ET. to have your telephone removed from our system. Either activity will cause the authentication to neglect, and as a result, balances will no longer be displayed pre-login on your lost phone.

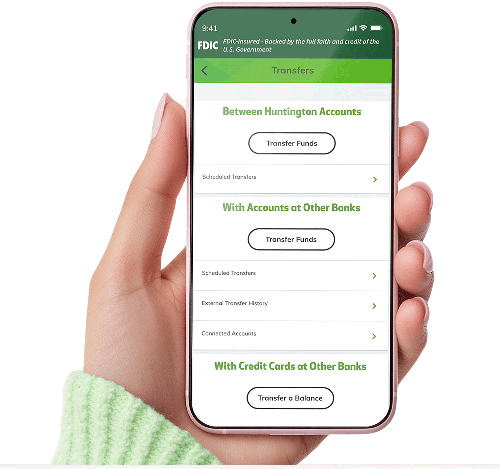

Can I transfer money betwixt banks on my mobile device?

Reply: Yes, you can transfer funds to and from other financial institutions with the Huntington Mobile app. Just open the app and tap the Transfers icon in the bottom. Under Accounts With Other Banks, tap Transfer Funds.

Please note that you must take the external account already prepare to be able to view transfer limits. To add a new external account, log into the Huntington Mobile app. Tap the Transfers tab and, nether With Accounts at Other Banks, choose Transfer Funds. Click on the "Add a new account" link and complete the required fields.

iMessage and data rates may employ. Message frequency depends on user preferences. Please consult your mobile carrier for details.

To opt out of text services, text End to 446622. For additional support text Help to 446622 for or call (800) 480-2265, daily 7:00 a.k. to 7:00 p.m. ET.

View terms and weather.

Larn more than about our Online Guarantee.

Our participating carriers include (simply are not limited to): AIO Wireless, Alltel, AT&T, Cablevision USA, Cincinnati Bell, Google Vocalization™, MetroPCS, Pioneer Wireless US, Pocket Com U.s.a., Simmerty US, SprintPCS, Tier iii US Carrier GL, T-Mobile®, Tracphone, Marriage Wireless, U.Due south. Cellular®, Verizon Wireless, Virgin Mobile Usa.

†Your account will be automatically closed if information technology remains negative in any corporeality for sixty days, including if your account is overdrawn within our $50 Prophylactic Zone. Learn more at huntington.com/SafetyZone and huntington.com/Grace.

Apple, the Apple logo, iPhone® and iPad® are trademarks of Apple Inc., registered in the U.S. and other countries. Apple Pay™ and Touch ID are trademarks of Apple Inc. Google Play™ is a trademark of Google Inc.

Voice Credit Card® and 24-60 minutes Grace® are federally registered service marks of Huntington Bancshares Incorporated. The 24-60 minutes Grace® system and method is patented. U.S. Pat No. eight,364,581, 8,781,955, 10,475,118, and others pending.

Nosotros are here to help.

If y'all can't find what you're looking for, let us know. We're gear up to help in person, online or on the phone.

Telephone call The states

To speak to a client service representative, telephone call (800) 480-2265.

Source: https://www.huntington.com/Personal/mobile-banking/mobile-banking-faq

0 Response to "Check Bounced Called Bank to Rrquest Runnimg Check Again"

Post a Comment